The 5 Methods Of Financing Your Startup That You Need To Know

Starting a new business is an exciting experience, but it’s also one that comes with many challenges, particularly when it comes to financing.

Whether you’re developing a new product or launching a new service, getting the right kind of finance is crucial to help your startup get off the ground. However, with so many options available, it can be challenging to know which finance option is right for your startup.

In this post, I’ll show you the various financing options available and help you determine which one is best suited to your company.

If you’re just getting to grips with startup financing, I’d recommend you take a look at this great introduction video by The Rest Of Us before getting started.

Bootstrapping

What is Bootstrapping?

Bootstrapping is a term used to describe creating a business with little-to-no outside investment.

Instead, of seeking external sources of money, you use your own personal savings (or the revenue generated by your previous business) to grow the company.

This method is often considered a more sustainable and secure way to finance a startup as it allows the business to maintain control and avoid the risks and pressures that come with outside funding.

Why Should You Bootstrap?

Bootstrapping forces you to be resourceful and creative with the resources that you have.

Without the luxury of outside funding, you need to be extra diligent to make sure that you optimize the resources that you do have. This mindset can lead to greater efficiency and profitability in the long run – see our guide to growing your business to 1 million dollars.

Bootstrapping also allows you to maintain full control over the business’ direction and decision-making.

With no outside investors to coordinate with, you are able to pursue your own vision without the pressure to meet the demands of shareholders or investors.

What Are The Challenges of Bootstrapping?

While bootstrapping can be an appealing option, it also comes with its fair share of challenges.

One of the biggest is the risk of running out of money to grow the business. Without outside funding, you’re often struggling with a limited cash flow, particularly in the early stages, which might cause your business to stall.

Bootstrapping can also limit the potential for rapid growth. Without outside funding, it can take much longer to scale your business and achieve any significant growth.

This may make your business miss out on potential opportunities or lose some of its market share to competitors who have access to greater resources and can develop and market quicker.

You can learn more about bootstrapping your startup in our dedicated blog post about it.

Venture Captial

What is Venture Capital?

Venture capital, or VC for short, is a form of startup financing where investors provide funding to early-stage companies in exchange for business equity.

This type of financing is typically only given to high-growth startups with significant market potential.

Venture capital firms work on a high-risk, high-reward model by giving large sums of money to a few businesses in the hopes that one of them will succeed. They not only provide funding to your business but also expertise, networks, and support to help the company grow and succeed.

What Are The Advantages of Venture Capital?

The main advantage of venture capital financing is that it provides your business with rapid access to substantial funds, allowing it to scale quickly.

Venture capital firms also have extensive networks and expertise which can help the company navigate the business landscape.

Another benefit of venture capital financing is that it can help attract top talent to the business. With a reputable venture capital firm’s backing, a startup can offer competitive compensation packages and demonstrate a high level of credibility and potential to potential employees.

What Are The Disadvantages of Venture Capital?

While venture capital financing can help to provide rapid growth to your company, it also comes with its fair share of challenges.

One significant drawback is the potential loss of control of your business. With investors from the venture capital firm now holding equity in your company, they will have a say in key decisions, such as hiring, strategy, and exit plans. This can limit your autonomy and flexibility within your own business.

Additionally, venture capital firms often have high expectations for returns on their investment. This can increase the amount of pressure on the business to achieve rapid growth and profitability, often at the expense of other business priorities and goals. Furthermore, due to the competitive nature of gaining venture capital finance, many startups fail to secure funding despite their potential.

Crowd Funding

What is Crowdfunding?

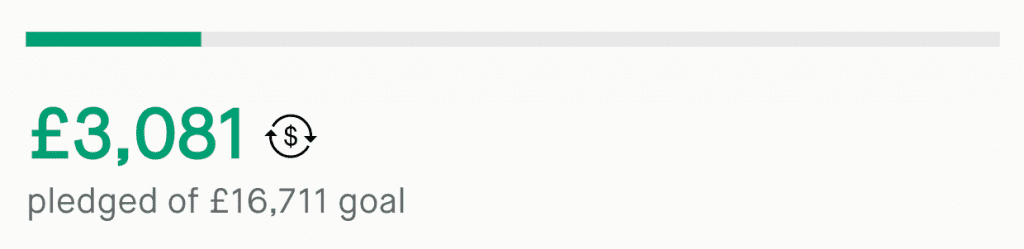

Crowdfunding is a method of raising funds for a business by getting contributions from a large number of people, usually through an online platform such as Kickstarter or IndieGoGo.

Crowdfunding platforms allow startups to create a campaign and set a funding goal, with backers contributing a certain amount of money to help the project reach its target.

Why Should I Use Crowdfunding?

Crowdfunding provides access to a vast network of potential investors, which allows you to gain funds quickly and efficiently.

Crowdfunding can also help to build a community who are invested in your business and provide valuable feedback as you develop. Also, crowdfunding doesn’t require you to sell equity in your startup, meaning that you still get to call the shots about what targets are set for your business.

Potential Crowdfunding Issues

However, there can also be some drawbacks to crowdfunding. One of the main disadvantages is the competition on crowdfunding platforms.

Thousands of campaigns are launched every day, meaning that it can be a challenge to get your product noticed. The most successful campaigns are normally performed by companies with at least some online presence before their launch, which can be an issue if your business is just starting out.

Additionally, crowdfunding requires a large amount of effort and time to create a compelling campaign, build a following, and manage communication with backers throughout the funding process. If your crowdfunding campaign doesn’t succeed, you could have wasted a large amount of time that could have been better spent on your business.

Bank Loans

A bank loan is a type of debt financing where a startup borrows money from a financial institution (such as a bank) with the promise to pay back the loan with interest over a set period of time. Bank loans are a popular form of funding for startups as they provide lump sums of capital upfront that can be used to fund the business.

Advantages of Loans

One of the main benefits of bank loans is that they typically offer lower interest rates than other forms of debt financing, meaning that they will cost the business less in the long term. Bank loans generally offer a fixed repayment schedule, which can help businesses to manage their finances more effectively. Bank loans can also establish a positive credit history for the business, which can help the startup to qualify for more favourable lending terms in the future.

Disadvantages of Bank Loans

Banks can be very selective in their lending practices and may require a high credit score, collateral, or a strong business plan to qualify for a loan, which can be difficult for a small startup to produce. Additionally, bank loans may have strict repayment terms and penalties for late payments, which can be challenging for new startups to afford. Typically, startups need $10k-$15k MRR before bank loans become a possible use of financing, which makes it almost impossible for new startups to use this method of funding.

Angel Investors

What are Angel Investors?

Angel investors are individuals who invest money into a startup in exchange for equity or part-ownership of the company. Angel investors typically invest smaller amounts than venture capitalists and may be more focused on supporting new and innovative businesses rather than maximising financial returns.

One of the main differences between angel investors and venture capitalists is the size of the investment. Angel investors typically invest between $25,000 and $100,000, while venture capitalists usually invest $2 million+. Angel investors may also be more willing to take on greater risks and invest in startups that are still in the early stages of development, while venture capitalists tend to focus on companies that have already achieved some level of success and are looking to grow.

Why Should My Business Have an Angel Investor?

One of the major benefits of angel investing is that it can provide early-stage startups with access to capital and expertise that may be difficult to obtain through other funding sources. Angel investors often have experience and expertise in a particular industry or field and can provide valuable advice and support to startups at any stage of their journey. Additionally, angel investors are usually more flexible in their investment terms, allowing startups to negotiate a deal that works best for their specific business structure.

Potential Issues With Angel Investments

Angel investors typically require a percentage of ownership in the company in exchange for their investment, which can dilute the founder’s ownership of the business and in turn, their decision-making power. Angel investors may have different goals and objectives than the founder, which can lead to conflicts over the direction of the company. If a business is also looking for a large investment, angel investors may not have the same level of financial resources as venture capitalists, which can limit their ability to provide long-term support and investment.

What’s The Best Financing Option For My Startup?

It’s difficult to provide a catch-all answer to the best financing option for businesses. Like so many things, the right answer comes down to a number of specifics about the business. While each option should be meticulously researched before committing, as a general rule:

- Bootstrapping is a great option for startups who are looking to create a lifestyle business or a business that they don’t intend to grow beyond a small business

- Crowdfunding is a great option for a founder who is looking to create a small business but needs some initial capital to get the product off the ground. While there can be a lot of initial work involved in running a crowdfunding campaign if done right it can provide the necessary cash injection without requiring any long-term commitment from the founder

- Angel Investors are ideal for businesses that have solid business plans (and potentially the base of a product) that are looking for a larger investment and mentorship and are willing to dilute the business ownership.

- Bank Loans are a good fit for business owners who are comfortably achieving at least $10k-15k MRR and are looking for a decent-sized loan without the dilution of ownership

- Venture Capital Firms are ideal for larger businesses that have a proven project and have the potential to grow into a multi-million dollar company with the right investment.

Overview

Now that you understand the different types of funding that your business can receive, have a look at how to grow your business to a multi-million dollar company, or discover how to use SEO to get free traffic to your site.